So, you’re considering taking the Enrolled Agent Exam, officially known as the Special Enrollment Exam (SEE). First off, congratulations on taking the first step toward a rewarding career in tax representation. This is not just any exam; it’s your gateway to becoming an IRS-recognized tax professional. Let’s dive into what this exam is all about.

- Purpose: The EA Exam serves as a rigorous assessment designed to qualify tax practitioners to represent taxpayers before the Internal Revenue Service (IRS). Once you pass, you earn the prestigious title of an “Enrolled Agent,” making you federally authorized to handle tax matters.

- Skills Measured: The exam evaluates your expertise in tax planning, individual and business tax return preparation, and representation. It’s not just about crunching numbers; it’s about understanding tax law, ethical considerations, and effective communication.

- Format: The exam is divided into three parts:

- Individuals

- Businesses

- Representation, Practices, and Procedures

- Frequency: The exam is offered during three testing windows each year, giving you ample time for preparation.

- Cost: Expect to pay around $182 per part, totaling $546 for the entire exam. This doesn’t include prep materials or courses, so budget accordingly.

- Pass Rate: The pass rate hovers around 60% for each part, which means you’ll need more than just a casual understanding of tax codes and regulations to succeed.

- Language: The exam is administered in English, so proficiency is a must.

- Eligibility: There are no educational prerequisites, but you must have a Preparer Tax Identification Number (PTIN) from the IRS before you can sit for the exam.

Intrigued? You should be. The EA Exam is challenging but incredibly rewarding. It’s a career-defining milestone that can open doors to opportunities you’ve never imagined. So, buckle up and get ready for an intense but fulfilling journey of prep and practice. Stay tuned for more insights on question types, preparation strategies, and much more.

Did you know?

Each section of the EA Exam has different weightings for scoring, so every question isn’t equal. Success often comes to those with practical tax experience, not just book smarts. The exam is computer-based at Prometric centers, and your scores can influence not just your job eligibility but also your starting salary and role in tax firms. These details can be game-changers in your test prep and career.

EA Exam Parts Explained

The Enrolled Agent Exam, or Special Enrollment Exam (SEE), is a comprehensive test divided into three distinct parts. Each part is designed to assess specific skills and knowledge areas related to tax representation. Let’s break down what each part entails and the skills you’ll need to ace them.

- Individuals: This part focuses on taxation for individuals. You’ll be tested on income and assets, deductions and credits, and ethical considerations specific to individual taxpayers. To excel, you’ll need a strong grasp of Form 1040, itemized deductions, and an understanding of tax issues affecting individuals such as retirement and estate planning.

- Businesses: This section is all about business taxation. It covers various types of business entities like corporations, partnerships, and sole proprietorships. You’ll need to know how to prepare different business tax returns, understand business deductions, and be familiar with laws affecting businesses, such as the Affordable Care Act.

- Representation, Practices, and Procedures: This part assesses your ability to represent clients before the IRS. It includes topics like the rules governing practices, powers of attorney, and types of IRS audits. To do well, you’ll need to understand the ethical and procedural aspects of tax representation, including how to handle audits, appeals, and collections.

The Enrolled Agent Exam is divided into three main parts, each assessing different skills and knowledge areas in the field of tax representation. Below is a summary table that outlines the focus of each part, the skills needed to excel, the number of questions, and the time allocated for each section.

| Exam Part | Focus | Skills Needed | Number of Questions | Time Allocated |

|---|---|---|---|---|

| Individuals | Taxation for individuals | Form 1040, itemized deductions, retirement and estate planning | 100 | 3.5 hours |

| Businesses | Business taxation | Business tax returns, business deductions, Affordable Care Act compliance | 100 | 3.5 hours |

| Representation, Practices, and Procedures | Representing clients before the IRS | Ethical and procedural aspects, audits, appeals, and collections | 100 | 3.5 hours |

Each part requires a different set of skills, but they all demand a deep understanding of U.S. tax code, regulations, and ethical guidelines. As you prepare, tailor your study approach to the unique challenges presented by each section.

Part 1: Individuals

The first part of the Enrolled Agent Exam, commonly known as the “Individuals” section, is a crucial stepping stone in your journey to becoming an Enrolled Agent. This section delves deep into the complexities of individual taxation. Below are tables outlining the key topics you’ll need to master for this part of the exam.

Income Types

| Topic | Details |

|---|---|

| Wages and Salaries | Understand the tax implications of W-2 income. |

| Dividends and Interest | Know how qualified and non-qualified dividends are taxed. |

| Capital Gains and Losses | Be familiar with short-term vs. long-term capital gains and their taxation. |

| Retirement Income | Understand the taxation of pensions, Social Security, and other retirement income. |

| Self-Employment Income | Grasp the nuances of Schedule C and self-employment taxes. |

Filing Status

| Status | Details |

|---|---|

| Single | Know the standard deductions and tax brackets. |

| Married Filing Jointly | Understand the benefits and drawbacks. |

| Married Filing Separately | Learn when this status is advantageous. |

| Head of Household | Know the qualifications and benefits. |

Form 1040

| Component | Details |

|---|---|

| Main Form | Master the various lines and boxes, including income, adjustments, and credits. |

| Schedules | Understand the purpose of each schedule, such as Schedule A for itemized deductions and Schedule D for capital gains. |

Deductions and Credits

| Type | Details |

|---|---|

| Standard Deduction | Know the amounts for different filing statuses. |

| Itemized Deductions | Understand categories like medical expenses, state and local taxes, and mortgage interest. |

| Tax Credits | Be familiar with credits like the Earned Income Tax Credit, Child Tax Credit, and Education Credits. |

Retirement and Estate Planning

| Topic | Details |

|---|---|

| IRA Contributions | Understand the limits and tax benefits. |

| 401(k) and Other Employer Plans | Know the contribution limits and withdrawal rules. |

| Estate Tax | Understand the federal estate tax thresholds and how gifts can affect estate tax. |

Special Circumstances

| Topic | Details |

|---|---|

| Alternative Minimum Tax (AMT) | Know when this applies and how it’s calculated. |

| Foreign Income | Understand the Foreign Earned Income Exclusion and tax treaties. |

| Tax Penalties | Be aware of penalties for early withdrawal from retirement accounts and underpayment of taxes. |

The “Individuals” section of the EA Exam is a comprehensive and challenging part that tests your knowledge on a wide array of topics related to individual taxation. Mastery of these key topics is essential for not just passing the exam but also for your future role as an Enrolled Agent. Prepare thoroughly, and you’ll be well on your way to acing this part of the exam.

Part 1 Sample Question

Which of the following tax credits is refundable?

- Earned Income Tax Credit

- Foreign Tax Credit

- Child and Dependent Care Credit

- Residential Energy Efficient Property Credit

Correct Answer: A. Earned Income Tax Credit

- A. Earned Income Tax Credit: This is the correct answer. The Earned Income Tax Credit is refundable, meaning if the credit exceeds the amount of taxes owed, the excess will be returned to the taxpayer as a refund. (Source: IRS Publication 596)

- B. Foreign Tax Credit: This is also a non-refundable credit. It can offset taxes owed but will not result in a refund. (Source: IRS Publication 514)

- C. Child and Dependent Care Credit: This credit is non-refundable, meaning it can reduce your tax liability to zero but won’t provide a refund beyond that. (Source: IRS Publication 503)

- D. Residential Energy Efficient Property Credit: This credit is non-refundable. It can reduce your tax liability but will not result in a refund. (Source: IRS Form 5695 Instructions)

The Earned Income Tax Credit is the only option among the given that is refundable, as specified in IRS guidelines.

Part 2: Businesses

The second part of the Enrolled Agent Exam, known as the “Businesses” section, is another critical component in your journey to becoming an Enrolled Agent. This section focuses on the taxation of various business entities. Below are tables that outline the key topics you’ll need to master for this part of the exam.

Types of Business Entities

| Topic | Details |

|---|---|

| Sole Proprietorship | Understand taxation through Schedule C and self-employment taxes. |

| Partnership | Know how partnerships are taxed and the implications for individual partners. |

| Corporation | Be familiar with corporate tax rates, dividends, and capital gains. |

| S Corporation | Understand how income flows through to individual shareholders. |

Business Income and Deductions

| Topic | Details |

|---|---|

| Business Income | Understand types of income like sales, services, and royalties. |

| Business Expenses | Know deductible expenses including cost of goods sold, wages, and rent. |

| Depreciation | Grasp the basics of depreciation methods like MACRS. |

Employment Taxes

| Topic | Details |

|---|---|

| Social Security and Medicare | Understand employer and employee contributions. |

| Federal Unemployment Tax | Know the rates and conditions under which it applies. |

| Self-Employment Tax | Understand how it differs from employment taxes for employees. |

Special Business Tax Considerations

| Topic | Details |

|---|---|

| Affordable Care Act | Understand the tax implications for businesses. |

| Business Credits | Be familiar with credits like the Work Opportunity Credit. |

| Penalties and Audits | Know the types of penalties businesses may face and how audits are conducted. |

The “Businesses” section of the EA Exam is a comprehensive test that covers a broad range of topics related to business taxation. Mastery of these topics is not only crucial for passing this part of the exam but also for your future role as an Enrolled Agent. With focused preparation, you’ll be well-equipped to tackle this challenging section.

Part 2 Sample Question

A corporation has a net operating loss (NOL) for the current tax year. What can the corporation do with this NOL?

- Carry it back 2 years and forward 20 years

- Carry it back 3 years and forward 15 years

- Carry it forward indefinitely, but not carry it back

- Use it only in the current year and lose any remaining NOL

Correct Answer: C. Carry it forward indefinitely, but not carry it back

- A. Carry it back 2 years and forward 20 years: This was the rule prior to the Tax Cuts and Jobs Act (TCJA) of 2017 but is no longer applicable for NOLs arising in tax years beginning after December 31, 2017. (Source: IRS Publication 536)

- B. Carry it back 3 years and forward 15 years: This option is incorrect and does not align with current or past IRS guidelines for NOLs. (Source: IRS Publication 536)

- C. Carry it forward indefinitely, but not carry it back: This is the correct answer. According to the TCJA, NOLs arising in tax years beginning after December 31, 2017, can be carried forward indefinitely but cannot be carried back. (Source: IRS Publication 536)

- D. Use it only in the current year and lose any remaining NOL: This is incorrect. NOLs can be carried forward to offset future taxable income. (Source: IRS Publication 536)

The correct treatment of NOLs for corporations has been updated by the TCJA, and the current rule allows for indefinite carryforward but no carryback, as specified in IRS guidelines.

Part 3: Representation, Practices, and Procedures

The third and final part of the Enrolled Agent Exam, known as the “Representation, Practices, and Procedures” section, is your last hurdle in becoming an Enrolled Agent. This part assesses your ability to represent clients before the IRS and covers a wide range of ethical and procedural topics. Below are tables outlining the key topics you’ll need to master for this part of the exam.

Rules and Regulations

| Topic | Details |

|---|---|

| Circular 230 | Understand the rules governing practice before the IRS. |

| Power of Attorney | Know the forms and procedures to legally represent a taxpayer. |

| Sanctions and Penalties | Be familiar with the consequences of unethical or illegal practices. |

Types of Representation

| Topic | Details |

|---|---|

| Audits | Understand the types of audits and how to handle them. |

| Appeals | Know the procedures for appealing an IRS decision. |

| Collections | Be familiar with collection processes like liens and levies. |

Client Interactions

| Topic | Details |

|---|---|

| Confidentiality | Understand the ethical requirements for client confidentiality. |

| Conflict of Interest | Know how to identify and manage conflicts of interest. |

| Record-Keeping | Be familiar with the requirements for maintaining client records. |

Special Procedures

| Topic | Details |

|---|---|

| Innocent Spouse Relief | Understand the conditions under which it applies. |

| Installment Agreements | Know how to set up payment plans with the IRS. |

| Offers in Compromise | Be familiar with the process of negotiating tax liabilities. |

The “Representation, Practices, and Procedures” section of the EA Exam is a comprehensive test of your ability to ethically and effectively represent clients before the IRS. Mastery of these topics is essential for not only passing the exam but also for your future role as an Enrolled Agent. With thorough preparation, you’ll be well-prepared to complete your journey to becoming an Enrolled Agent.

Part 3 Sample Question

An Enrolled Agent (EA) is representing a taxpayer during an IRS audit. The taxpayer has a balance due. Which of the following options can the EA recommend to the taxpayer?

- Ignore the balance due as it will eventually be written off by the IRS.

- Set up an installment agreement with the IRS.

- File for bankruptcy to eliminate the tax debt.

- Advise the taxpayer to leave the country to avoid paying the IRS.

Correct Answer: B. Set up an installment agreement with the IRS.

- A. Ignore the balance due as it will eventually be written off by the IRS: This is incorrect and could lead to further penalties and interest. The IRS does not simply write off balances due. (Source: IRS Publication 594)

- B. Set up an installment agreement with the IRS: This is the correct answer. An installment agreement is a common method to resolve a balance due with the IRS. (Source: IRS Form 9465)

- C. File for bankruptcy to eliminate the tax debt: Bankruptcy does not necessarily eliminate tax debt and should only be considered as a last resort. (Source: IRS Publication 908)

- D. Advise the taxpayer to leave the country to avoid paying the IRS: This is not only incorrect but also illegal and could result in criminal charges. (Source: IRS Criminal Investigation Process)

The correct option for dealing with a balance due during an IRS audit is to set up an installment agreement, as per IRS guidelines.

Preparation Strategies

So, you’ve decided to take the Enrolled Agent Exam, also known as the Special Enrollment Exam (SEE). Congratulations on making a career-defining choice! But let’s get one thing straight: this exam is no walk in the park. It’s a rigorous test that requires a deep understanding of U.S. tax code, ethics, and procedures. But fear not, with the right preparation strategy, you can conquer this beast. Here’s how:

- Start Early: The earlier you start, the better. This isn’t an exam you can cram for in a week. Give yourself at least 3-6 months of dedicated study time.

- Understand the Exam Structure: Know the exam inside and out. Understand the different parts and what each section assesses. This will help you tailor your study plan effectively.

- Get the Right Materials: Invest in quality study materials. Whether it’s textbooks, online resources, or practice exams, make sure they’re up-to-date and comprehensive.

- Create a Study Plan: Don’t just open a book and start reading. Create a structured study plan that covers all the topics you need to know. Stick to it religiously.

- Focus on Weak Areas: As you go through your study materials, identify your weak areas and spend extra time on them. Don’t just review what you already know; that’s a waste of time.

- Practice, Practice, Practice: The more you practice, the more comfortable you’ll be on exam day. Take as many practice exams as you can, and always time yourself.

- Review IRS Publications: The IRS publications are your bible for this exam. Make sure you’re familiar with the most relevant ones.

- Stay Updated: Tax laws change. Keep yourself updated with the latest changes in tax laws and IRS procedures.

- Simulate Exam Conditions: A couple of months before the exam, start taking practice tests under exam conditions. This will help you manage your time better and reduce exam-day anxiety.

- Rest Before the Exam: Don’t underestimate the power of a good night’s sleep. Your brain needs to be in optimal condition on exam day.

In conclusion, the Enrolled Agent Exam is a challenging but conquerable hurdle. With the right preparation strategy, you can not only pass but excel in this exam. Remember, the key to success in the EA Exam is a balanced combination of disciplined study, focused practice, and strategic planning. So, roll up your sleeves and get to work; your future as an Enrolled Agent awaits!

“Taking the Enrolled Agent Exam was a rigorous but rewarding experience. The test is comprehensive and covers a wide range of topics from individual taxation to business entities. The questions were challenging, but fair. They really test your understanding of the tax code and your ability to apply it in various scenarios. I felt like the exam was designed not just to test rote memorization, but to assess your real-world problem-solving skills.”

Source: reddit user

Test Features

The Purpose of the Exam

The Enrolled Agent Exam, officially known as the Special Enrollment Examination (SEE), serves as the gateway to becoming an Enrolled Agent. The primary purpose of this exam is to assess your comprehensive understanding of the federal tax code, ethics, and representation procedures. Passing the exam qualifies you to represent taxpayers before the Internal Revenue Service (IRS), offering you a career that’s both rewarding and challenging.

Computer-Based Testing

The EA Exam is administered through a computer-based testing platform. This offers you the flexibility to navigate between questions, mark items for review, and change answers within a section before final submission. The interface is user-friendly, designed to make your test-taking experience as smooth as possible.

Three-Part Structure

The exam is divided into three distinct parts: Individuals, Businesses, and Representation, Practices, and Procedures. Each part is designed to test specific areas of expertise, ensuring that Enrolled Agents are well-rounded professionals capable of handling a variety of tax-related issues.

Question Types

The exam primarily consists of multiple-choice questions. These questions are designed to test not just your knowledge, but also your ability to apply that knowledge in different scenarios. The questions often include real-world situations that require a deep understanding of tax laws and procedures.

Time Management

Each part of the exam has a specific time limit, pushing you to manage your time efficiently. The clock is visible on the computer screen, allowing you to keep track of the time as you work through the questions. Time management is crucial, as you’ll need to pace yourself to answer all questions within the allotted time.

Review and Change Answers

The exam’s computer-based format allows you to review and change your answers within a section before you finalize your submission. This feature is particularly useful for questions that you may find challenging or need more time to think about.

Accessibility Features

The exam is designed to be accessible to all test-takers, including those with disabilities. Special accommodations can be made upon request, ensuring that everyone has an equal opportunity to become an Enrolled Agent.

In summary, the Enrolled Agent Exam is a meticulously designed assessment tool that not only tests your knowledge but also your ability to apply that knowledge in a professional setting. Its features are tailored to provide a comprehensive, fair, and accessible testing experience.

Common names for the EA Exam

- Special Enrollment Examination (SEE)

- EA Exam

- IRS Special Enrollment Exam

- Enrolled Agent Special Exam

- IRS EA Exam

These are some of the common names you might encounter when researching or discussing the Enrolled Agent Exam. Each refers to the same comprehensive test that qualifies you to represent taxpayers before the IRS.

“For me, the key to acing the EA Exam was a combination of structured study and practice exams. I dedicated at least two hours a day to studying, focusing on one section at a time. I also took full-length practice exams every weekend to gauge my progress. This helped me identify my weak areas and allocate more time to them. I can’t stress enough how important it is to simulate exam conditions during your practice tests; it really prepares you for the real thing.”

Source: reddit user

Technical Facts

Test Fast Facts (tl;dr)

- 3.5 hours per part

- 100 questions each part

- 40-130 scoring scale

- 105 to pass

- May 1 – Feb 28 window

- Prometric test centers

- 24-hour retake wait

- $182 per part

- Two IDs required

- 2-year expiration

Exam Duration

Each part of the Enrolled Agent Exam is 3.5 hours long, making the total duration of the exam 10.5 hours. This does not include the additional time allocated for administrative procedures, such as checking in and reading instructions.

Number of Questions

Each part of the exam consists of 100 multiple-choice questions. These questions are divided into different sections based on the subject matter, and each section has its own set of questions.

Scoring Scale

The exam is scored on a scale of 40 to 130, with a passing score of 105. The score is not a percentage but rather a scaled score that takes into account the difficulty of the questions.

Exam Windows

The exam is offered during specific windows throughout the year. These windows are generally May 1 to February 28 of the following year. The exam is not offered during March and April, which are peak tax seasons.

Exam Eligibility and Registration

Before you can take the Enrolled Agent Exam, there are certain eligibility criteria you must meet and registration steps you must follow. This table outlines the key steps and requirements for becoming eligible to take the exam.

| Step | Description | Timeline |

|---|---|---|

| Confirm Eligibility | Ensure you have a PTIN (Preparer Tax Identification Number) | Before Registration |

| Schedule Exam | Use Prometric’s website to schedule your exam | 2-3 months prior |

| Pay Fees | Pay the exam fee for each part you plan to take | At time of scheduling |

| Receive Confirmation | You’ll receive a confirmation email with details about your test appointment | Immediately after payment |

Test Centers

The exam is administered at Prometric test centers across the United States and in some international locations. You must schedule your exam appointment in advance, and availability may vary by location.

Retake Policy

If you fail a part of the exam, you can retake it, but you must wait a period of 24 hours before rescheduling. There is no limit to the number of times you can retake a failed section, but each retake requires a new exam fee.

Exam Fee

As of my last update in September 2021, the fee for each part of the exam is $182. This fee is non-refundable and must be paid at the time of scheduling your exam.

Identification Requirements

You must present two forms of identification at the test center. One must be a government-issued photo ID, such as a driver’s license or passport. The other can be a secondary ID, like a credit card.

Calculator Policy

You are not allowed to bring your own calculator to the exam. However, a basic on-screen calculator is provided during the exam for your use.

Exam Day Requirements

Knowing what to bring and what to expect on the day of the Enrolled Agent Exam can ease your nerves and help you focus on performing your best. This table provides a checklist of items to bring and what to expect upon arrival at the test center.

| Item to Bring | Purpose |

|---|---|

| Two Forms of ID | Identification verification |

| Confirmation Email | Proof of exam appointment |

| Snacks/Water | For breaks (stored in locker) |

| What to Expect | Description |

|---|---|

| Security Check | All candidates are subject to security checks |

| Tutorial | Brief tutorial on how to use the computer interface |

Results Availability

Your exam results are typically available immediately upon completion of the test. However, official score reports may take up to four weeks to be sent to you.

Post-Exam Steps

Once you’ve completed the Enrolled Agent Exam, there are several important steps to take to finalize your status as an Enrolled Agent. This table outlines the post-exam steps you’ll need to follow.

| Step | Description | Timeline |

|---|---|---|

| Receive Score | You’ll receive your score report via email | 4-6 weeks |

| Apply for Enrollment | Submit Form 23 to the IRS | After passing |

| Background Check | The IRS will conduct a background check | After application |

| Receive EA Certificate | You’ll receive your official Enrolled Agent certificate | After approval |

Expiration of Passed Parts

Once you pass a part of the exam, you have a two-year window to pass the remaining parts. If you do not pass all parts within this timeframe, you will lose credit for the part passed first, and the two-year window resets.

In summary, the Enrolled Agent Exam has specific technical aspects that you must be aware of, from the number of questions and scoring scale to the retake policy and exam fees. Understanding these technical facts will help you navigate the exam process more smoothly.

“I found that creating a study group was incredibly beneficial for my preparation. We met twice a week to discuss difficult topics and quiz each other. This collaborative approach helped me understand concepts that I found challenging. We also shared resources and study materials, which enriched my own study plan. I strongly recommend finding or creating a study group if you’re serious about passing the EA Exam.”

Source: reddit user

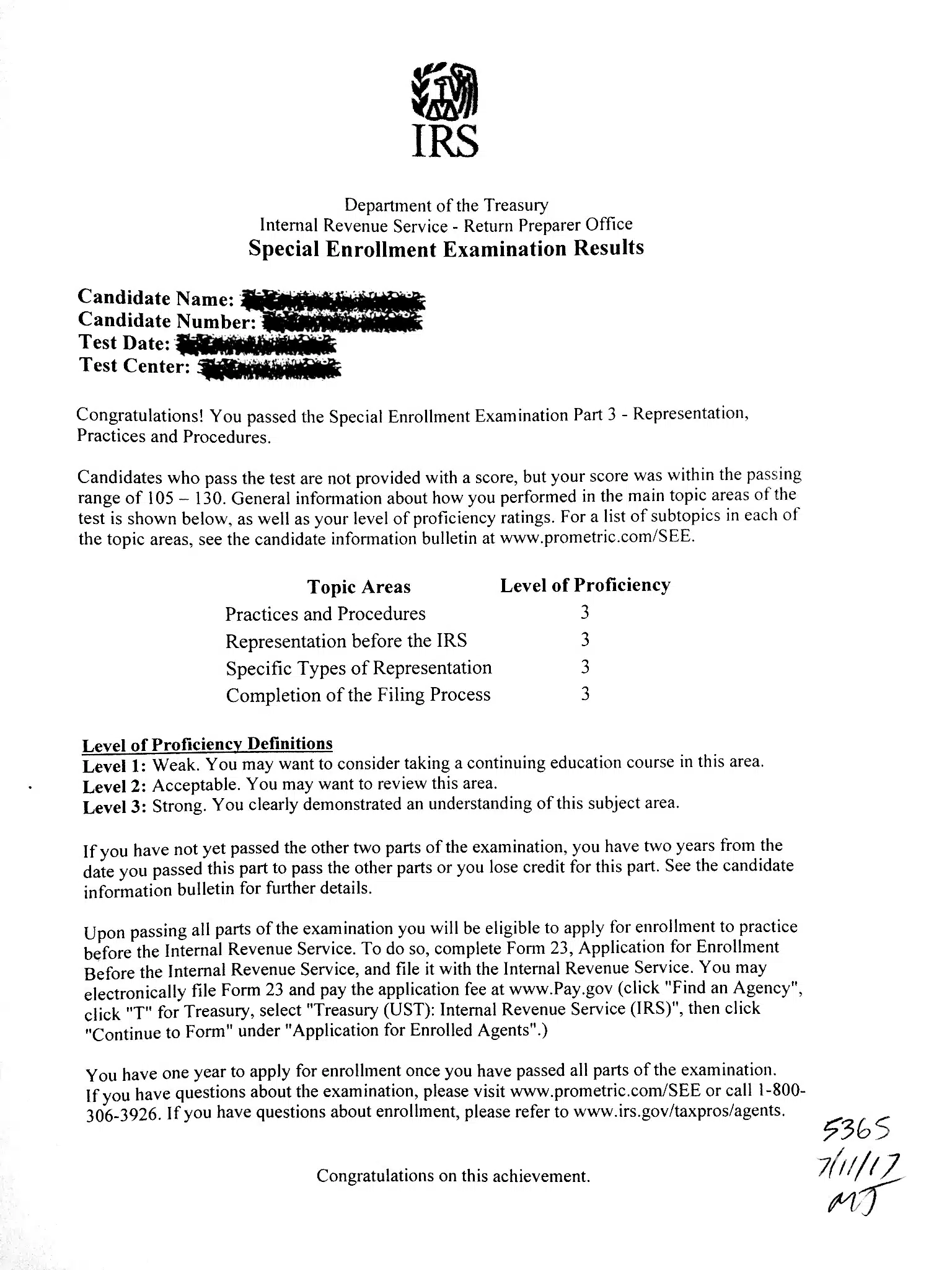

Results Scale and Interpretations

Understanding your score on the Enrolled Agent Exam, or the Special Enrollment Examination (SEE), is crucial not just for knowing whether you’ve passed, but also for assessing your strengths and weaknesses. The score report is a comprehensive document that provides various metrics, each serving a specific purpose. Let’s delve into the different components of the score report and how to interpret them.

Raw Score

Your raw score is the most straightforward metric—it’s simply the number of questions you answered correctly. However, this is not the score that determines whether you pass or fail the exam. The raw score is converted into a scaled score.

Scaled Score

The scaled score ranges from 40 to 130, with a passing score of 105. This score is calculated to account for any variations in difficulty across different sets of exam questions. For example, if you get a scaled score of 110, you’ve passed the exam.

Percentile Ranking

The percentile ranking indicates what percentage of test-takers scored lower than you. For instance, if your percentile ranking is 85, it means you scored higher than 85% of test-takers. This gives you a relative sense of how well you performed.

Sub-Scores

Sub-scores are provided for different sections or domains of the exam, such as Individuals, Businesses, and Representation. These scores can help you identify your strong and weak areas, which is particularly useful if you need to retake the exam.

Score Range

The score report often includes a score range, which gives you an idea of the range within which your true ability lies. This is based on the statistical likelihood that if you took the exam multiple times, your scores would fall within this range.

Suggested Score Ranges

- Below 95: Indicates a need for substantial improvement.

- 95-104: You’re close but need to focus on weak areas.

- 105 and above: You’ve passed and demonstrated strong knowledge.

Using the Score Report for Assessment

Your score report is a valuable tool for self-assessment. By examining your scaled score, percentile ranking, and sub-scores, you can gauge not only your readiness to serve as an Enrolled Agent but also identify areas where further study is needed.

Scoring Example

Let’s say you took the Individuals part of the Enrolled Agent Exam and received the following scores:

- Raw Score: 82 out of 100

- Scaled Score: 110

- Percentile Ranking: 88

- Sub-Scores:

- Income: 85

- Deductions: 80

- Credits: 90

- Score Range: 107-113

In this example, your raw score of 82 was converted to a scaled score of 110, which is above the passing score of 105. Your percentile ranking of 88 means you performed better than 88% of test-takers. The sub-scores indicate that you are particularly strong in the “Credits” section but could improve in “Deductions.” Your score range of 107-113 suggests that your true ability likely falls within this range.

| Metric | Score | Interpretation |

|---|---|---|

| Raw Score | 82 | Number of correct answers |

| Scaled Score | 110 | Above the passing score of 105 |

| Percentile Rank | 88 | Scored higher than 88% of test-takers |

| Sub-Scores | Varies | Strong in “Credits,” needs improvement in “Deductions” |

| Score Range | 107-113 | Likely true ability falls within this range |

In conclusion, the score report of the Enrolled Agent Exam is a multi-faceted document that offers a wealth of information. Understanding how to interpret these scores can provide you with valuable insights into your performance and readiness for a career as an Enrolled Agent. So, when you receive that score report, don’t just look for the pass or fail—take the time to understand what those numbers really mean.

iPREP: Concise. Focused. What you need.

Sign up

Immediate access

Practice

Online self-paced

Pass

Ace that Test!

FAQs

The Enrolled Agent Exam, officially known as the Special Enrollment Examination (SEE), is a comprehensive test that qualifies you to represent taxpayers before the Internal Revenue Service (IRS).

The exam measures your understanding of the federal tax code, ethics, and representation procedures. It is divided into three parts: Individuals, Businesses, and Representation, Practices, and Procedures.

The exam is computer-based and consists of multiple-choice questions. Each of the three parts contains 100 questions.

Each part of the exam is 3.5 hours long, making the total duration 10.5 hours, not including additional time for administrative procedures.

The exam is scored on a scale of 40 to 130, with a passing score of 105.

Yes, you can retake a failed section, but you must wait 24 hours before rescheduling. Each retake requires a new exam fee.

Your score report includes a raw score, scaled score, percentile ranking, and sub-scores for different sections. It provides insights into your performance and areas for improvement.

Yes, the exam is administered at Prometric test centers across the United States and in some international locations.

Employers view a passing score on the EA Exam as a strong indicator of your expertise in tax-related matters. It can significantly boost your job prospects in the field of taxation.

Once you pass a part of the exam, you have a two-year window to pass the remaining parts. If you don’t pass all parts within this timeframe, you lose credit for the part passed first, and the two-year window resets.

Test Tips

You’ve prepared well, and now it’s time to execute. The Enrolled Agent Exam is a serious undertaking, and how you approach it on test day can make all the difference. Here are seven practical tips to help you navigate the exam effectively:

- Arrive Early: Aim to get to the test center at least 30 minutes early. This will give you ample time to check in and settle down.

- Bring Proper Identification: Don’t overlook this simple but crucial step. Two forms of ID are required, and one must be a government-issued photo ID.

- Dress in Layers: Test centers can vary in temperature. Dressing in layers allows you to adjust and stay comfortable.

- Read Every Question Carefully: Misinterpretation can cost you points. Make sure to read each question and its answer choices thoroughly.

- Pace Yourself: Time management is key. Keep an eye on the clock to ensure you’re allocating time wisely across questions.

- Use the Elimination Method: If you’re unsure about an answer, eliminate the options that are clearly incorrect. This strategy can improve your chances of selecting the right answer.

- Review, But Don’t Overthink: The exam allows you to flag questions for review. Use this feature, but trust your initial instincts when revisiting questions.

These tips are designed to give you an edge on test day. Follow them, and you’ll be well-positioned to demonstrate your expertise and become an Enrolled Agent.

“Flashcards were my go-to study aid for the Enrolled Agent Exam. I made a set for each section of the exam and reviewed them daily. This helped reinforce my memory and made it easier to recall key facts and figures during the exam. I also used a spaced repetition system to make my study sessions more effective. This method helped me focus on the areas where I needed the most improvement.”

Source: reddit user

Administration

- Test Location: The exam is administered at Prometric test centers, both within the United States and in some international locations.

- Test Schedule: The exam is offered from May 1 to February 28 of the following year. You’ll need to schedule your exam appointment in advance.

- Test Format: The exam is computer-based and consists entirely of multiple-choice questions.

- Test Materials: You cannot bring your own materials like pen and paper. An on-screen calculator is provided for calculations.

- Cost: As of my last update in September 2021, the cost for each part of the exam is $182, payable at the time of scheduling.

- Retake Policy: If you fail a part, you can retake it after waiting 24 hours. Each retake requires a new exam fee.

Test Provider

The Enrolled Agent Exam, officially known as the Special Enrollment Examination (SEE), is administered by Prometric on behalf of the Internal Revenue Service (IRS). Prometric is a global leader in test administration, established in 1990, and offers a wide range of services including test development, test delivery, and data management.

Prometric operates in more than 160 countries, providing a broad array of testing services across multiple sectors such as academia, government, and healthcare. Aside from the Enrolled Agent Exam, some of their top products include tests for medical licensing, IT certifications, and professional licensures. Their extensive network and experience make them a reliable choice for administering high-stakes exams like the SEE.

Information Sources

- Prometric official EA exam page

- IRS official EA Exam page

- National Association of Enrolled Agents EA Exam page

Disclaimer – All the information and prep materials on iPREP are genuine and were created for tutoring purposes. iPREP is not affiliated with Prometric o the IRS, or with any of the companies or organizations mentioned above.

Free Enrolled Agent Exam Prep: Get to know what the EA Exam will be like by practicing with these sample questions:

Part 1 – Individuals: Sample Questions

Question 1 of 10

Which of the following is considered a “qualifying child” for the Earned Income Tax Credit (EITC)?

- A 25-year-old full-time college student who lives with you.

- A 16-year-old high school student who lives with you and for whom you are the legal guardian.

- A 30-year-old disabled child who lives in a separate residence.

- A 17-year-old who lives with you but provides more than half of their own support.

Answer: B. A 16-year-old high school student who lives with you and for whom you are the legal guardian.

Explanation:

- Option A is incorrect because the age limit for a “qualifying child” for EITC purposes is under 19, or under 24 if a full-time student, as per IRC § 152(c)(3).

- Option B is correct. A 16-year-old high school student who lives with you and for whom you are the legal guardian meets the criteria for a “qualifying child” for EITC as per IRC § 32(c)(3).

- Option C is incorrect because the child must live with you for more than half the year to be considered a “qualifying child,” as per IRC § 152(c)(1)(B).

- Option D is incorrect because a “qualifying child” must not provide more than half of their own support, as per IRC § 152(c)(1)(D).

Source: Internal Revenue Code (IRC) §§ 152(c)(3), 32(c)(3), 152(c)(1)(B), 152(c)(1)(D)

Question 2 of 10

Which of the following types of income is not subject to the Net Investment Income Tax (NIIT)?

- Wages

- Rental income

- Dividends

- Capital gains

Answer: A. Wages

Explanation:

- Option A is correct because wages are not considered net investment income and are therefore not subject to NIIT, as per IRC § 1411(c)(5).

- Option B is incorrect because rental income is also subject to NIIT under IRC § 1411(c)(1)(A)(iii).

- Option C is incorrect because dividends are subject to NIIT as per IRC § 1411(c)(1)(A)(i).

- Option D is incorrect because capital gains are subject to NIIT under IRC § 1411(c)(1)(A)(iii).

Source: Internal Revenue Code (IRC) §§ 1411(c)(1)(A)(i), 1411(c)(1)(A)(iii), 1411(c)(5)

Question 3 of 10

Under what circumstances can a taxpayer exclude the gain from the sale of their main home?

- The taxpayer lived in the home for at least 1 out of the last 5 years.

- The taxpayer lived in the home for at least 2 out of the last 5 years and did not exclude gain from another home sale in the last 2 years.

- The taxpayer lived in the home for at least 3 out of the last 5 years.

- The taxpayer lived in the home for at least 2 out of the last 5 years and the sale price was below $250,000.

Answer: B. The taxpayer lived in the home for at least 2 out of the last 5 years and did not exclude gain from another home sale in the last 2 years.

Explanation:

- Option A is incorrect because the taxpayer must have lived in the home for at least 2 out of the last 5 years to qualify for the exclusion, as per IRC § 121(a).

- Option B is correct. The taxpayer must have lived in the home for at least 2 out of the last 5 years and not have excluded gain from another home sale in the last 2 years, as per IRC § 121(b)(3).

- Option C is incorrect because the requirement is 2 out of the last 5 years, not 3, according to IRC § 121(a).

- Option D is incorrect because the sale price is not a factor for the exclusion, as per IRC § 121.

Source: Internal Revenue Code (IRC) §§ 121(a), 121(b)(3)

Question 4 of 10

What is the maximum amount that can be contributed to a Roth IRA for individuals under 50 years old for the tax year 2021?

- $5,000

- $6,000

- $6,500

- $7,000

Answer: B. $6,000

Explanation:

- Option A is incorrect because the maximum contribution limit for individuals under 50 for the tax year 2021 is not $5,000, as per IRC § 408A(c)(2).

- Option B is correct. The maximum contribution limit for individuals under 50 for the tax year 2021 is $6,000, as per IRC § 408A(c)(2).

- Option C is incorrect because $6,500 is the maximum contribution limit for individuals who are 50 or older, according to IRC § 408A(c)(3).

- Option D is incorrect because there is no such limit of $7,000 for individuals under 50, as per IRC § 408A(c)(2).

Source: Internal Revenue Code (IRC) §§ 408A(c)(2), 408A(c)(3)

Question 5 of 10

Which of the following is not a deductible medical expense?

- Prescription medications

- Health insurance premiums

- Over-the-counter vitamins

- Doctor’s fees

Answer: C. Over-the-counter vitamins

Explanation:

- Option A is incorrect because prescription medications are deductible medical expenses as per IRC § 213(d)(1)(A).

- Option B is incorrect because health insurance premiums are deductible as per IRC § 213(d)(1)(D).

- Option C is correct. Over-the-counter vitamins are generally not deductible unless they are prescribed by a medical practitioner, as per IRC § 213(d)(3).

- Option D is incorrect because doctor’s fees are deductible medical expenses as per IRC § 213(d)(1)(A).

Source: Internal Revenue Code (IRC) §§ 213(d)(1)(A), 213(d)(1)(D), 213(d)(3)

Question 6 of 10

What is the standard deduction for a single taxpayer under the age of 65 for the tax year 2021?

- $12,200

- $12,400

- $12,550

- $12,750

Answer: C. $12,550

Explanation:

- Option A is incorrect because $12,200 was the standard deduction for the tax year 2019, not 2021, as per IRC § 63(c)(7).

- Option B is incorrect because $12,400 was the standard deduction for the tax year 2020, not 2021, as per IRC § 63(c)(7).

- Option C is correct. The standard deduction for a single taxpayer under the age of 65 for the tax year 2021 is $12,550, as per IRC § 63(c)(7).

- Option D is incorrect because there is no such standard deduction amount of $12,750 for single taxpayers under 65 for the tax year 2021, as per IRC § 63(c)(7).

Source: Internal Revenue Code (IRC) § 63(c)(7)

Question 7 of 10

Which of the following taxpayers is not eligible for the Child Tax Credit?

- A taxpayer with a dependent child aged 16.

- A taxpayer with a dependent child aged 17.

- A taxpayer with a dependent child aged 18 and a full-time student.

- A taxpayer with a dependent child aged 19 and not a full-time student.

Answer: D. A taxpayer with a dependent child aged 19 and not a full-time student.

Explanation:

- Option A is incorrect because a dependent child aged 16 is eligible for the Child Tax Credit as per IRC § 24(c)(1).

- Option B is incorrect because a dependent child aged 17 is also eligible for the Child Tax Credit as per IRC § 24(c)(1).

- Option C is incorrect because a dependent child aged 18 who is a full-time student is eligible for the Child Tax Credit as per IRC § 24(c)(1).

- Option D is correct. A dependent child aged 19 who is not a full-time student is not eligible for the Child Tax Credit, as per IRC § 24(c)(1).

Source: Internal Revenue Code (IRC) § 24(c)(1)

Question 8 of 10

What is the maximum amount of the Lifetime Learning Credit that can be claimed per tax return in 2021?

- $1,000

- $2,000

- $2,500

- $3,000

Answer: B. $2,000

Explanation:

- Option A is incorrect because the maximum amount of the Lifetime Learning Credit is not $1,000, as per IRC § 25A(c)(1).

- Option B is correct. The maximum amount of the Lifetime Learning Credit that can be claimed per tax return in 2021 is $2,000, as per IRC § 25A(c)(1).

- Option C is incorrect because $2,500 is the maximum amount for the American Opportunity Credit, not the Lifetime Learning Credit, as per IRC § 25A(i)(1).

- Option D is incorrect because there is no such limit of $3,000 for the Lifetime Learning Credit, as per IRC § 25A(c)(1).

Source: Internal Revenue Code (IRC) §§ 25A(c)(1), 25A(i)(1)

Question 9 of 10

What is the penalty for failing to file a tax return by the due date, assuming no tax is owed?

- No penalty

- $50

- $135 or 100% of the unpaid tax, whichever is smaller

- $210

Answer: A. No penalty

Explanation:

- Option A is correct. If no tax is owed, there is generally no penalty for failing to file a tax return by the due date, as per IRC § 6651(a)(1).

- Option B is incorrect because there is no flat $50 penalty for failing to file, as per IRC § 6651(a)(1).

- Option C is incorrect because the penalty of $135 or 100% of the unpaid tax applies only when there is unpaid tax, as per IRC § 6651(a)(1).

- Option D is incorrect because there is no flat $210 penalty for failing to file, as per IRC § 6651(a)(1).

Source: Internal Revenue Code (IRC) § 6651(a)(1)

Question 10 of 10

Which of the following is not considered earned income for the purpose of calculating the Earned Income Tax Credit (EITC)?

- Interest and dividends

- Self-employment income

- Wages, salaries, and tips

- Union strike benefits

Answer: A. Interest and dividends

Explanation:

- Option A is correct. Interest and dividends are not considered earned income for the purpose of EITC, as per IRC § 32(c)(2)(B).

- Option B is incorrect because self-employment income is also considered earned income for the purpose of EITC, as per IRC § 32(c)(2)(A)(ii).

- Option C is incorrect because wages, salaries, and tips are considered earned income for the purpose of EITC, as per IRC § 32(c)(2)(A)(i).

- Option D is incorrect because union strike benefits are considered earned income for the purpose of EITC, as per IRC § 32(c)(2)(A)(iii).

Source: Internal Revenue Code (IRC) §§ 32(c)(2)(A)(i), 32(c)(2)(A)(ii), 32(c)(2)(B), 32(c)(2)(A)(iii)

Part 2 – Businesses: Sample Questions

Question 1 of 10

What is the maximum amount of Section 179 expense deduction a business can claim for qualifying property placed in service in the tax year 2021?

- $500,000

- $1,000,000

- $1,050,000

- $1,500,000

Answer: C. $1,050,000

Explanation:

- Option A is incorrect because the maximum Section 179 expense deduction for 2021 is not $500,000, as per IRC § 179(b)(1).

- Option B is incorrect because the maximum Section 179 expense deduction for 2021 is not $1,000,000, as per IRC § 179(b)(1).

- Option C is correct. The maximum Section 179 expense deduction for qualifying property placed in service in the tax year 2021 is $1,050,000, as per IRC § 179(b)(1).

- Option D is incorrect because there is no such limit of $1,500,000 for the Section 179 expense deduction, as per IRC § 179(b)(1).

Source: Internal Revenue Code (IRC) § 179(b)(1)

Question 2 of 10

Which of the following types of corporations is not subject to the Alternative Minimum Tax (AMT)?

- C Corporation

- S Corporation

- Personal Holding Company

- Professional Service Corporation

Answer: B. S Corporation

Explanation:

- Option A is incorrect because C Corporations were subject to AMT prior to the Tax Cuts and Jobs Act of 2017, as per IRC § 55.

- Option B is correct. S Corporations are generally not subject to the Alternative Minimum Tax, as per IRC § 1363(a).

- Option C is incorrect because Personal Holding Companies could be subject to AMT, as per IRC § 542.

- Option D is incorrect because Professional Service Corporations could also be subject to AMT, as per IRC § 448.

Source: Internal Revenue Code (IRC) §§ 55, 1363(a), 542, 448

Question 3 of 10

What is the deadline for filing Form 1120, U.S. Corporation Income Tax Return, for a calendar-year corporation?

- March 15

- April 15

- April 30

- May 15

Answer: B. April 15

Explanation:

- Option A is incorrect because March 15 is the deadline for S Corporations and partnerships to file their returns, as per IRC § 6072(b).

- Option B is correct. The deadline for filing Form 1120 for a calendar-year corporation is April 15, as per IRC § 6072(b).

- Option C is incorrect because there is no such deadline of April 30 for filing Form 1120, as per IRC § 6072(b).

- Option D is incorrect because there is no such deadline of May 15 for filing Form 1120, as per IRC § 6072(b).

Source: Internal Revenue Code (IRC) § 6072(b)

Question 4 of 10

What is the maximum amount of Net Operating Loss (NOL) that a corporation can carry back to offset prior year’s income?

- 50% of the prior year’s income

- 80% of the prior year’s income

- 100% of the prior year’s income

- NOL cannot be carried back, only carried forward

Answer: D. NOL cannot be carried back, only carried forward

Explanation:

- Option A is incorrect because the Tax Cuts and Jobs Act of 2017 eliminated the provision allowing corporations to carry back NOLs to offset 50% of prior year’s income, as per IRC § 172(b)(1)(A).

- Option B is incorrect because the 80% limitation applies to carrying forward NOLs, not carrying them back, as per IRC § 172(a).

- Option C is incorrect because the provision allowing 100% carryback was eliminated by the Tax Cuts and Jobs Act of 2017, as per IRC § 172(b)(1)(A).

- Option D is correct. As of the Tax Cuts and Jobs Act of 2017, NOLs can only be carried forward, not back, as per IRC § 172(b)(1)(A).

Source: Internal Revenue Code (IRC) §§ 172(a), 172(b)(1)(A)

Question 5 of 10

What is the tax rate for a Personal Holding Company (PHC) on its undistributed PHC income?

- 15%

- 20%

- 25%

- 30%

Answer: D. 30%

Explanation:

- Option A is incorrect because the tax rate for a PHC on its undistributed PHC income is not 15%, as per IRC § 541(a).

- Option B is incorrect because the tax rate for a PHC on its undistributed PHC income is not 20%, as per IRC § 541(a).

- Option C is incorrect because the tax rate for a PHC on its undistributed PHC income is not 25%, as per IRC § 541(a).

- Option D is correct. The tax rate for a Personal Holding Company on its undistributed PHC income is 30%, as per IRC § 541(a).

Source: Internal Revenue Code (IRC) § 541(a)

Question 6 of 10

What is the deadline for a partnership to file Form 1065, U.S. Return of Partnership Income, for a calendar-year partnership?

- March 15

- April 15

- May 15

- June 15

Answer: A. March 15

Explanation:

- Option A is correct. The deadline for a calendar-year partnership to file Form 1065 is March 15, as per IRC § 6072(b).

- Option B is incorrect because April 15 is the deadline for individual taxpayers and C Corporations, not partnerships, as per IRC § 6072(a).

- Option C is incorrect because there is no such deadline of May 15 for filing Form 1065, as per IRC § 6072(b).

- Option D is incorrect because there is no such deadline of June 15 for filing Form 1065, as per IRC § 6072(b).

Source: Internal Revenue Code (IRC) §§ 6072(a), 6072(b)

Question 7 of 10

Under what conditions can a corporation make tax-free distributions to its shareholders?

- When the distribution is a return of capital

- When the distribution is from current earnings and profits

- When the distribution is from accumulated earnings and profits

- When the distribution is a dividend

Answer: A. When the distribution is a return of capital

Explanation:

- Option A is correct. A corporation can make tax-free distributions to its shareholders when the distribution is a return of capital, as per IRC § 301(c)(2).

- Option B is incorrect because distributions from current earnings and profits are generally taxable as dividends, as per IRC § 301(c)(1).

- Option C is incorrect because distributions from accumulated earnings and profits are also generally taxable as dividends, as per IRC § 301(c)(1).

- Option D is incorrect because dividends are generally taxable to the shareholders, as per IRC § 301(c)(1).

Source: Internal Revenue Code (IRC) §§ 301(c)(1), 301(c)(2)

Question 8 of 10

What is the maximum amount of qualified business income (QBI) deduction a single taxpayer can claim in 2021?

- 20% of QBI

- 50% of W-2 wages

- 25% of W-2 wages plus 2.5% of the unadjusted basis of qualified property

- None of the above

Answer: A. 20% of QBI

Explanation:

- Option A is correct. The maximum amount of qualified business income (QBI) deduction a single taxpayer can claim in 2021 is 20% of QBI, as per IRC § 199A(a).

- Option B is incorrect because the 50% of W-2 wages limitation is one of the conditions that may apply but is not the maximum amount of the QBI deduction, as per IRC § 199A(b)(2).

- Option C is incorrect because the 25% of W-2 wages plus 2.5% of the unadjusted basis of qualified property is another condition that may apply but is not the maximum amount of the QBI deduction, as per IRC § 199A(b)(2).

- Option D is incorrect because one of the above options is correct, specifically Option A.

Source: Internal Revenue Code (IRC) §§ 199A(a), 199A(b)(2)

Question 9 of 10

What is the tax treatment of meals and entertainment expenses incurred in entertaining a client?

- 100% deductible

- 80% deductible

- 50% deductible

- Not deductible

Answer: C. 50% deductible

Explanation:

- Option A is incorrect because meals and entertainment expenses are not 100% deductible, as per IRC § 274(n)(1).

- Option B is incorrect because meals and entertainment expenses are not 80% deductible, as per IRC § 274(n)(1).

- Option C is correct. Meals and entertainment expenses incurred in entertaining a client are generally 50% deductible, as per IRC § 274(n)(1).

- Option D is incorrect because these expenses are not entirely non-deductible; they are 50% deductible, as per IRC § 274(n)(1).

Source: Internal Revenue Code (IRC) § 274(n)(1)

Question 10 of 10

What is the depreciation method generally used for most tangible property placed in service in a general business credit?

- Straight-line method

- Double declining balance method

- Modified Accelerated Cost Recovery System (MACRS)

- Sum-of-the-years-digits method

Answer: C. Modified Accelerated Cost Recovery System (MACRS)

Explanation:

- Option A is incorrect because the straight-line method is not generally used for most tangible property placed in service in a general business credit, as per IRC § 168(b).

- Option B is incorrect because the double declining balance method is not generally used for most tangible property placed in service in a general business credit, as per IRC § 168(b).

- Option C is correct. The Modified Accelerated Cost Recovery System (MACRS) is generally used for most tangible property placed in service in a general business credit, as per IRC § 168(a).

- Option D is incorrect because the sum-of-the-years-digits method is not generally used for most tangible property placed in service in a general business credit, as per IRC § 168(b).

Source: Internal Revenue Code (IRC) §§ 168(a), 168(b)

Part 3 – Representation, Practices, and Procedures: Sample Questions

Question 1 of 10

What is the maximum penalty for willfully failing to file a tax return?

- $1,000

- $10,000

- $25,000

- $100,000

Answer: D. $100,000

Explanation:

- Option A is incorrect because the maximum penalty for willfully failing to file a tax return is not $1,000, as per IRC § 7203.

- Option B is incorrect because the maximum penalty for willfully failing to file a tax return is not $10,000, as per IRC § 7203.

- Option C is incorrect because the maximum penalty for willfully failing to file a tax return is not $25,000, as per IRC § 7203.

- Option D is correct. The maximum penalty for willfully failing to file a tax return is $100,000 for individuals and $200,000 for corporations, as per IRC § 7203.

Source: Internal Revenue Code (IRC) § 7203

Question 2 of 10

What is the minimum period for which a tax lien remains on a taxpayer’s credit report?

- 10 years

- 7 years

- 3 years

- 15 years

Answer: A. 10 years

Explanation:

- Option A is correct. The minimum period for which a tax lien remains on a taxpayer’s credit report is 10 years, as per IRC § 6323.

- Option B is incorrect because the minimum period for which a tax lien remains on a taxpayer’s credit report is not 7 years, as per IRC § 6323.

- Option C is incorrect because the minimum period for which a tax lien remains on a taxpayer’s credit report is not 3 years, as per IRC § 6323.

- Option D is incorrect because the minimum period for which a tax lien remains on a taxpayer’s credit report is not 15 years, as per IRC § 6323.

Source: Internal Revenue Code (IRC) § 6323

Question 3 of 10

What is the maximum amount of time the IRS generally has to assess additional tax after the original filing?

- 1 year

- 3 years

- 6 years

- 10 years

Answer: B. 3 years

Explanation:

- Option A is incorrect because the IRS generally has more than 1 year to assess additional tax, as per IRC § 6501(a).

- Option B is correct. The IRS generally has 3 years from the date of the original filing to assess additional tax, as per IRC § 6501(a).

- Option C is incorrect because the 6-year period applies in certain special cases, such as substantial omission of income, but is not the general rule, as per IRC § 6501(e).

- Option D is incorrect because the IRS generally does not have 10 years to assess additional tax after the original filing, as per IRC § 6501(a).

Source: Internal Revenue Code (IRC) §§ 6501(a), 6501(e)

Question 4 of 10

What is the minimum penalty for filing a frivolous tax return?

- $100

- $500

- $1,000

- $5,000

Answer: D. $5,000

Explanation:

- Option A is incorrect because the minimum penalty for filing a frivolous tax return is not $100, as per IRC § 6702(a).

- Option B is incorrect because the minimum penalty for filing a frivolous tax return is not $500, as per IRC § 6702(a).

- Option C is incorrect because the minimum penalty for filing a frivolous tax return is not $1,000, as per IRC § 6702(a).

- Option D is correct. The minimum penalty for filing a frivolous tax return is $5,000, as per IRC § 6702(a).

Source: Internal Revenue Code (IRC) § 6702(a)

Question 5 of 10

What is the maximum amount of the penalty for failure to file Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR)?

- $10,000

- $50,000

- $100,000

- $500,000

Answer: C. $100,000

Explanation:

- Option A is incorrect because the maximum penalty for failure to file FBAR is not $10,000, as per 31 U.S.C. § 5321(a)(5)(C).

- Option B is incorrect because the maximum penalty for failure to file FBAR is not $50,000, as per 31 U.S.C. § 5321(a)(5)(C).

- Option C is correct. The maximum penalty for failure to file FBAR is $100,000, as per 31 U.S.C. § 5321(a)(5)(C).

- Option D is incorrect because the maximum penalty for failure to file FBAR is not $500,000, as per 31 U.S.C. § 5321(a)(5)(C).

Source: 31 U.S.C. § 5321(a)(5)(C)

Question 6 of 10

What is the minimum age at which a person can become an Enrolled Agent?

- 30 years

- 21 years

- 25 years

- 18 years

Answer: D. 18 years

Explanation:

- Option A is incorrect because the minimum age is not 30 years, as per Treasury Department Circular No. 230, Section 10.4.

- Option B is incorrect because the minimum age is not 21 years, as per Treasury Department Circular No. 230, Section 10.4.

- Option C is incorrect because the minimum age is not 25 years, as per Treasury Department Circular No. 230, Section 10.4.

- Option D is correct. The minimum age at which a person can become an Enrolled Agent is 18 years, as per Treasury Department Circular No. 230, Section 10.4.

Source: Treasury Department Circular No. 230, Section 10.4

Question 7 of 10

What is the standard period for which the IRS can audit a tax return?

- 1 year

- 3 years

- 6 years

- 10 years

Answer: B. 3 years

Explanation:

- Option A is incorrect because the standard period for which the IRS can audit a tax return is not 1 year, as per IRC § 6501(a).

- Option B is correct. The standard period for which the IRS can audit a tax return is 3 years from the date of the original filing, as per IRC § 6501(a).

- Option C is incorrect because the 6-year period applies in certain special cases, such as substantial omission of income, but is not the general rule, as per IRC § 6501(e).

- Option D is incorrect because the IRS generally does not have 10 years to audit a tax return after the original filing, as per IRC § 6501(a).

Source: Internal Revenue Code (IRC) §§ 6501(a), 6501(e)

Question 8 of 10

What is the minimum amount of tax liability that triggers the requirement for a corporation to make estimated tax payments?

- $500

- $1,000

- $2,500

- $5,000

Answer: A. $500

Explanation:

- Option A is correct. The minimum amount of tax liability that triggers the requirement for a corporation to make estimated tax payments is $500, as per IRC § 6655(a).

- Option B is incorrect because the minimum amount is not $1,000, as per IRC § 6655(a).

- Option C is incorrect because the minimum amount is not $2,500, as per IRC § 6655(a).

- Option D is incorrect because the minimum amount is not $5,000, as per IRC § 6655(a).

Source: Internal Revenue Code (IRC) § 6655(a)

Question 9 of 10

What is the maximum amount of time a taxpayer has to file a claim for a tax refund?

- 3 years

- 2 years

- 1 year

- 4 years

Answer: A. 3 years

Explanation:

- Option A is correct. The maximum amount of time a taxpayer has to file a claim for a tax refund is generally 3 years from the date the original return was filed or 2 years from the date the tax was paid, whichever is later, as per IRC § 6511(a).

- Option B is incorrect because the maximum amount of time a taxpayer has to file a claim for a tax refund is not 2 years, as per IRC § 6511(a).

- Option C is incorrect because the maximum amount of time a taxpayer has to file a claim for a tax refund is not 1 year, as per IRC § 6511(a).

- Option D is incorrect because the maximum amount of time a taxpayer has to file a claim for a tax refund is not 4 years, as per IRC § 6511(a).

Source: Internal Revenue Code (IRC) § 6511(a)

Question 10 of 10

What is the maximum penalty for unauthorized disclosure of tax return information by a tax preparer?

- $1,000

- $5,000

- $10,000

- $25,000

Answer: C. $10,000

Explanation:

- Option A is incorrect because the maximum penalty for unauthorized disclosure of tax return information by a tax preparer is not $1,000, as per IRC § 6713(a).

- Option B is incorrect because the maximum penalty for unauthorized disclosure of tax return information by a tax preparer is not $5,000, as per IRC § 6713(a).

- Option C is correct. The maximum penalty for unauthorized disclosure of tax return information by a tax preparer is $10,000, as per IRC § 6713(a).

- Option D is incorrect because the maximum penalty for unauthorized disclosure of tax return information by a tax preparer is not $25,000, as per IRC § 6713(a).

Source: Internal Revenue Code (IRC) § 6713(a)

Well done!

You have completed the Sample Questions section.

The complete iPREP course includes full test simulations with detailed explanations and study guides.

‘…TESTS THAT ACTUALLY HELP’

In the first 30 minutes of use I have learned so much more than skipping along the internet looking for free content. Don’t waste you time, pay and get tests that actually help.

Richard Rodgers

January 28, 2020 at 7:49 PM